capital gains tax canada crypto

If you don. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances.

Crypto Taxation 7 Things You Should Know Metrics Chartered Professional Accounting

Similarly if you incur losses these are treated as either business losses or capital losses for tax purposes.

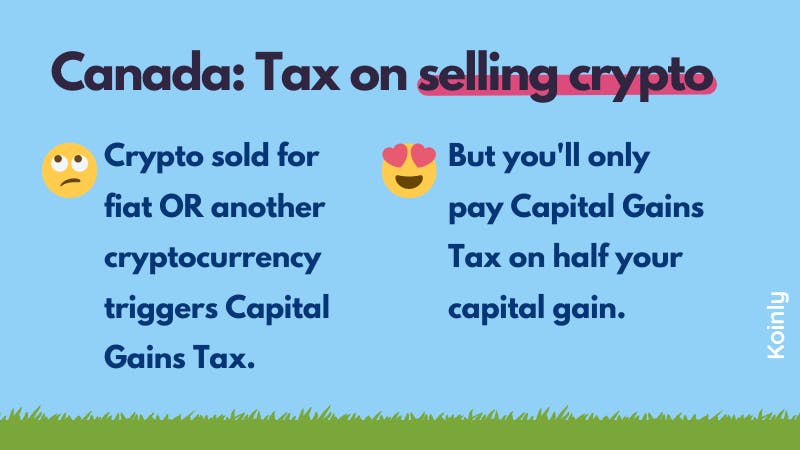

. The CRA treats cryptocurrencies similarly to commodities such that the tax implications are that individuals in. If the sale of a cryptocurrency does not constitute carrying on a business and the amount it sells for is more than the original purchase price or its adjusted cost base then the taxpayer has realized a capital gain. If your crypto disposal is treated as a capital gain half of your gain will be subject to tax.

This means that 50 of your gain is added to your income for the year and charged at your marginal rate. How is crypto tax calculated in Canada. But if you waited until July 20 2021 to sell your Litecoin for 107 you would pay 15 in taxes or 975 65 x 15 on your long-term capital gains.

Note that only 50 of capital gains are taxable. Instead any earnings considered to be capital gains are taxed at the same rate as your federal income tax and provincial income tax rate. The Canadian Revenue Agency CRA has published a detailed tax guide for the taxation of cryptocurrencies and digital assets such as bitcoin.

50 per cent of gains are included into income with capital gains vs. In Canada you only pay tax on 50 of any realized capital gains. This means that half of the money you earn from selling an asset is taxed and the other half is yours to keep tax-free.

When calculating crypto capital gains you are required to use an adjusted cost basis. If your crypto transaction is deemed to be business-like then your generated income will be taxed at your. When it comes time to file your capital gains taxes youll have to look for the Schedule 3 tax form for capital gains or losses.

Remember you will only pay tax on your gains not your entire crypto investment. Capital gains on cryptos are taxed at the same rate as your federal and provincial income tax rates. The amount of tax you pay on crypto in Canada depends on whether you are considered to be operating a crypto business or simply trading crypto for capital gains.

Heres 8 ways to avoid crypto tax in Canada in 2022. 100 of business income is taxable while only 50 of income received from capital gains is taxable. Capital gains from the sale of cryptocurrency are generally included in income for the year but only half of the capital gain is subject to tax.

That Capital Gain would then be taxed at a tax rate of 50 2000 x 50 1000 which would apply a 1000 gain on your personal tax return as income. Taxes on cryptocurrencies are considered as either capital gains tax or as income tax in Canada. For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto.

The Canada Revenue Agency CRA treats cryptocurrency as a property taxed either as business income or capital gains. Things change if youre a business. Cryptocurrency earnings are treated as a capital gain or business income meaning that you will have to pay capital gains tax or income.

Crypto in Canada is subject to Income Tax or Capital Gains Tax - depending on the specific transaction. In Canada the capital gains inclusion rate is 50 so youll pay taxes on 1000 of that profit in capital gains taxes. Capital gains are only 50 taxable.

Determine the adjusted cost base of your crypto assets. Why things change if youre running a business. Valuing cryptocurrency as inventory.

If the client bought the cryptocurrency five years ago and disposed of it for profit today the CRA would probably view the gain as a capital gain of which 50 is taxable. Cryptocurrencies are taking the financial world by storm and leaving a lot of Canadian investors confused about the correct way to report their crypto on their Canadian Tax returns. The CRA treats cryptocurrencies as a commodity and not a currency and as such crypto is subject to capital gains tax read the CRA guide.

Theyre considered business income or capital gains. In other words if you made 100 from crypto activity youd pay taxes on the full amount if its considered business income but youd pay tax on only 50 if. You might have to report that capital gains tax as.

There are no specific Capital Gains Tax rates in Canada and no short-term or long-term Capital Gains Tax rates. If you have a capital loss you can claim your losses against your gains to lower the total taxable amount. How to Calculate Capital Gains When Day Trading in Canada.

While 50 of capital gains are taxable 100 of business income is taxable. Crypto Capital Gains Tax Rate Canada. In Canada the CRA expects all Crypto-Currency transactions to be treated in the same manner as any commodity would.

Offset losses against gains. If youre married filing jointly with a combined income of 100000 you might pay 22 in taxes on your short-term capital gains 7524 342 x 22 and take home 26676 in profit. In Canada these two different forms of incomebusiness income vs.

While many countries including the US have special tax rates for capital gains this is not the case in Canada. Updated on September 21 2020. Learn about the Taxpayer responsibilities of Canadian crypto investors.

Adjusted Cost Base Explained. However only half of your capital gains are taxed. Business income where 100 per cent of the gain is included.

Similarly if you sold your cryptocurrency for less than you paid to buy it you have a capital loss. Establishing whether or not your transactions are part of a business is very important. When taxable events occur calculating and reporting profit loss and capital gains vs.

Cryptocurrencies of all kinds and NFTs are taxable in Canada. To calculate your capital gain or loss follow these steps. You may need to pay GSTHST on business transactions where you accepted payment in crypto and youll need to calculate and remit the amounts owed based on when they took place.

To muddy the waters further- US crypto tax. Capital gainsare taxed differently. This 100 free-of-charge service enables users to quickly generate accurate and organised.

Like Sedigh Rotfleisch suggested that a client continuously trading crypto would most likely generate business income. Crypto Taxes in Canada. While theres no way to legally cash out your crypto without paying taxes theres quite a few ways you can reduce your crypto tax bill.

If you sold your cryptocurrency for more than you paid to buy it you have a capital gain.

What To Know About Cryptocurrency And Taxes The New York Times

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Https Www Google Com Blank Html Gold Coins Buy Gold And Silver Gold

What Is Cryptocurrency How Does Crypto Impact Taxes H R Block

Canada Crypto Tax The Ultimate 2022 Guide Koinly

The Ultimate Guide To Canadian Crypto Tax Laws For 2022 Zenledger

Is Bitcoin Taxable In Canada Toronto Tax Lawyer

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

Coincub S Top Ten Global Crypto Economies For 2021 Q4 Agree Coincub Released Yesterday The Top 10 Of The World S Most Progre Global Financial Services Japan

Get The Insight On The Crypto Revolution With Capital Com Find Out What A Cryptocurrency Is And How It Works All About Cr Cryptocurrency Graphing Infographic

How To Calculate Capital Gains On Cryptocurrency Sdg Accountant

How To Cash Out Crypto Without Paying Taxes In Canada Jul 2022 Yore Oyster

Bitcoin Or Ether Check Out How To Buy Ethereum In 2022 Bitcoin Blockchain Buy Cryptocurrency

Crypto Mining Taxes What You Need To Know

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Do I Have To Pay Taxes On Crypto Yes Even If You Made Less Than 600 Taxbit

Canada Crypto Tax The Ultimate 2022 Guide Koinly